Featured

Table of Contents

It's cost-free, basic and secure. Whether home loan life insurance policy is the best plan for you depends mainly on your age and health. Youthful house owners with restricted medical issues will get far better quotes and better insurance coverage alternatives with term life insurance policy. On the other hand, if you have extreme illness and won't receive term life insurance policy, then home mortgage life insurance policy can be a good alternative, since it does not take your health into account when setting rates and will offer bigger survivor benefit than several alternatives.

Some plans connect the survivor benefit to the impressive home loan principal. This will behave similarly to a lowering fatality advantage, but if you pay off your home mortgage quicker or slower than anticipated, the policy will certainly show that. The death benefit will certainly continue to be the same over the life of the policy.

Depending upon the carrier, home mortgage life insurance policy. If the policy is tied to your home, you would need to obtain a brand-new plan if you move. And because life insurance policy quotes are tied to your age, this suggests the premium will be higher. A home loan protection plan that's bundled right into your home loan is even extra restrictive, as you can't select to cancel your protection if it ends up being unneeded.

You would certainly need to proceed spending for an unneeded advantage. Term and mortgage life insurance policy policies have numerous resemblances, but specifically if you're healthy and a nonsmoker. Below are a few of the essential distinctions between term life insurance coverage and mortgage life insurance coverage: Protection amountAny amountMortgage principalCoverage length540 yearsMortgage lengthBeneficiary Your choice Home mortgage lending institution Survivor benefit paidUpon your deathPossibly just upon your unintended deathUnderwritingHealth concerns and medical test Wellness concerns It's totally free, straightforward and safe and secure.

Compare Mortgage Protection Policies

If there are a lot more pressing costs at the time of your death or your household decides not to keep the residence, they can utilize the complete term-life insurance payout however they select. Home loan life insurance policy quotes are much more pricey for healthy and balanced homeowners, due to the fact that many plans do not require you to obtain a medical exam.

Right here's just how both contrast. Both home mortgage security insurance (MPI) and life insurance coverage are optional policies that supply some economic security to loved ones if you die. The essential difference: MPI coverage settles the continuing to be equilibrium on your home mortgage, whereas life insurance offers your recipients a survivor benefit that can be utilized for any type of objective.

Life Insurance Policy Mortgage

A lot of policies have a maximum limitation on the size of the mortgage balance that can be insured. This maximum quantity will certainly be explained when you use for your Home loan Life Insurance, and will certainly be documented in your certificate of insurance policy. Yet also if your beginning mortgage equilibrium is greater than the optimum limitation, you can still insure it up to that restriction.

They likewise such as the reality that the proceeds of her home mortgage life insurance will go directly to pay out the home loan equilibrium as opposed to possibly being made use of to pay other financial obligations. It is very important to Anne-Sophie that her household will have the ability to proceed living in their family members home, without financial duress.

Below's how the two compare. Both home mortgage defense insurance policy (MPI) and life insurance policy are optional policies that offer some economic protection to enjoyed ones if you die. The key distinction: MPI insurance coverage pays off the continuing to be equilibrium on your mortgage, whereas life insurance policy provides your recipients a death advantage that can be used for any type of purpose.

Home Insurance In Case Of Death

The majority of policies have a maximum limit on the dimension of the home loan balance that can be insured. This optimum quantity will certainly be described when you look for your Mortgage Life Insurance Policy, and will certainly be recorded in your certification of insurance. However also if your beginning mortgage balance is greater than the maximum limitation, you can still guarantee it approximately that restriction.

They also such as the truth that the earnings of her mortgage life insurance will go straight to pay the mortgage balance instead than perhaps being utilized to pay various other debts. It is necessary to Anne-Sophie that her household will have the ability to proceed residing in their household home, without financial duress.

Right here's just how both compare. Both home loan security insurance coverage (MPI) and life insurance policy are optional policies that use some financial protection to liked ones if you die. The key difference: MPI coverage repays the remaining balance on your home loan, whereas life insurance policy offers your recipients a death advantage that can be utilized for any objective.

A lot of plans have an optimum restriction on the size of the home mortgage balance that can be insured. This optimum amount will be clarified when you look for your Home mortgage Life Insurance Policy, and will be recorded in your certification of insurance. Even if your beginning home loan equilibrium is greater than the optimum limit, you can still guarantee it up to that limitation.

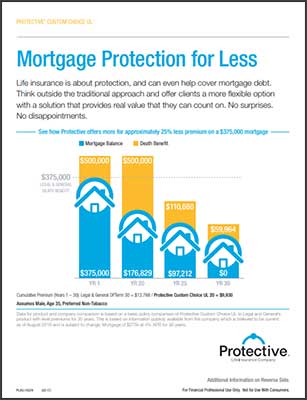

Mortgage Insurance Coverage Chart

They likewise such as the truth that the proceeds of her mortgage life insurance policy will certainly go directly to pay the home loan balance instead of perhaps being made use of to pay various other financial debts. It's vital to Anne-Sophie that her family will be able to proceed staying in their family members home, without financial duress.

Below's how both contrast. Both home loan security insurance (MPI) and life insurance policy are optional plans that use some monetary security to liked ones if you pass away. The crucial distinction: MPI coverage settles the staying balance on your mortgage, whereas life insurance policy offers your beneficiaries a survivor benefit that can be used for any type of purpose.

Should You Get Mortgage Protection Insurance

Many policies have a maximum restriction on the dimension of the mortgage equilibrium that can be guaranteed - mortgage cover plan. This maximum quantity will certainly be clarified when you request your Mortgage Life Insurance Policy, and will be recorded in your certification of insurance. However even if your starting mortgage equilibrium is greater than the maximum limit, you can still guarantee it up to that limitation.

They additionally such as the truth that the profits of her home mortgage life insurance coverage will go straight to pay the mortgage balance as opposed to potentially being used to pay other financial debts. It is very important to Anne-Sophie that her family will have the ability to continue living in their family members home, without economic pressure.

Here's how the 2 contrast. The vital distinction: MPI protection pays off the staying equilibrium on your mortgage, whereas life insurance gives your beneficiaries a death benefit that can be used for any type of purpose.

The majority of policies have an optimum restriction on the dimension of the mortgage equilibrium that can be guaranteed. insurance on mortgage loan. This maximum amount will be described when you apply for your Mortgage Life Insurance coverage, and will certainly be documented in your certificate of insurance policy. Also if your beginning home loan balance is greater than the maximum limitation, you can still insure it up to that restriction.

They also like the truth that the proceeds of her home mortgage life insurance policy will go directly to pay the mortgage equilibrium instead of potentially being made use of to pay other financial debts. It is very important to Anne-Sophie that her family will have the ability to continue staying in their family members home, without economic duress.

Insurance For Mortgage

Right here's exactly how the 2 contrast. The vital difference: MPI insurance coverage pays off the continuing to be balance on your mortgage, whereas life insurance offers your beneficiaries a death benefit that can be utilized for any type of objective.

Many policies have an optimum limitation on the dimension of the home loan equilibrium that can be guaranteed. This maximum quantity will certainly be discussed when you use for your Home loan Life Insurance Policy, and will certainly be documented in your certificate of insurance policy. Even if your starting mortgage balance is greater than the optimum limit, you can still insure it up to that limitation.

They likewise such as the fact that the profits of her home mortgage life insurance coverage will go straight to pay the home loan equilibrium as opposed to perhaps being used to pay various other financial debts (mortgage protection policy definition). It is very important to Anne-Sophie that her family will be able to continue staying in their family members home, without economic discomfort

Latest Posts

Funeral Policy With No Waiting Period

Instant Life Insurance Cover

No Life Insurance Burial