Featured

Table of Contents

That generally makes them a much more inexpensive option forever insurance policy coverage. Some term plans may not maintain the costs and survivor benefit the same in time. 30-year level term life insurance. You do not intend to incorrectly believe you're buying degree term coverage and then have your fatality advantage change later. Lots of people obtain life insurance coverage to assist monetarily safeguard their enjoyed ones in situation of their unexpected fatality.

Or you might have the alternative to transform your existing term coverage right into an irreversible policy that lasts the remainder of your life. Various life insurance policy plans have prospective advantages and downsides, so it is essential to comprehend each before you determine to buy a plan. There are a number of benefits of term life insurance policy, making it a popular selection for insurance coverage.

As long as you pay the costs, your recipients will obtain the survivor benefit if you die while covered. That said, it is very important to keep in mind that the majority of plans are contestable for 2 years which means insurance coverage could be retracted on death, should a misrepresentation be found in the app. Plans that are not contestable usually have actually a rated survivor benefit.

Key Features of Term Life Insurance Level Term Explained

Costs are usually reduced than entire life policies. You're not secured into an agreement for the rest of your life.

And you can't squander your plan throughout its term, so you will not get any kind of financial take advantage of your previous coverage. Similar to other sorts of life insurance policy, the expense of a degree term policy relies on your age, insurance coverage requirements, employment, way of living and health. Commonly, you'll locate extra affordable coverage if you're more youthful, healthier and less high-risk to insure.

Because degree term premiums remain the same for the period of coverage, you'll recognize specifically how much you'll pay each time. Level term coverage additionally has some versatility, permitting you to customize your plan with added features.

What is Term Life Insurance With Accelerated Death Benefit? Key Information for Policyholders

You may have to meet particular problems and certifications for your insurer to pass this motorcyclist. In enhancement, there might be a waiting duration of approximately six months prior to working. There additionally can be an age or time frame on the insurance coverage. You can add a youngster biker to your life insurance policy policy so it additionally covers your kids.

The death benefit is typically smaller, and protection usually lasts till your youngster turns 18 or 25. This rider may be a much more economical way to help ensure your children are covered as bikers can usually cover numerous dependents at the same time. When your youngster ages out of this coverage, it may be possible to transform the rider right into a new policy.

When comparing term versus permanent life insurance policy, it's vital to keep in mind there are a couple of various kinds. The most common kind of irreversible life insurance policy is entire life insurance policy, however it has some vital distinctions contrasted to level term protection. Level term life insurance definition. Here's a fundamental summary of what to think about when comparing term vs.

Entire life insurance policy lasts for life, while term insurance coverage lasts for a certain duration. The premiums for term life insurance policy are typically reduced than entire life insurance coverage. With both, the premiums remain the exact same for the duration of the policy. Whole life insurance policy has a cash worth part, where a section of the costs may grow tax-deferred for future requirements.

One of the major attributes of level term protection is that your premiums and your death advantage don't change. You might have protection that begins with a fatality advantage of $10,000, which could cover a mortgage, and after that each year, the fatality advantage will certainly lower by a collection quantity or percent.

As a result of this, it's frequently a much more cost effective kind of level term coverage. You may have life insurance policy with your employer, however it may not suffice life insurance policy for your needs. The primary step when acquiring a policy is figuring out exactly how much life insurance policy you require. Think about factors such as: Age Family members dimension and ages Work standing Revenue Financial obligation Lifestyle Expected final costs A life insurance policy calculator can assist figure out just how much you need to start.

What Are the Benefits of Joint Term Life Insurance?

After making a decision on a policy, finish the application. If you're approved, authorize the documentation and pay your very first premium.

You may desire to upgrade your recipient details if you've had any kind of considerable life changes, such as a marital relationship, birth or separation. Life insurance can occasionally feel complex.

No, level term life insurance policy doesn't have cash value. Some life insurance coverage plans have a financial investment feature that allows you to build cash value in time. A section of your costs settlements is set apart and can earn passion over time, which grows tax-deferred during the life of your insurance coverage.

You have some options if you still want some life insurance coverage. You can: If you're 65 and your coverage has run out, for instance, you might desire to buy a new 10-year degree term life insurance plan.

Everything You Need to Know About What Is Level Term Life Insurance

You may be able to convert your term protection right into a whole life plan that will certainly last for the rest of your life. Many types of degree term policies are convertible. That suggests, at the end of your insurance coverage, you can convert some or all of your plan to entire life insurance coverage.

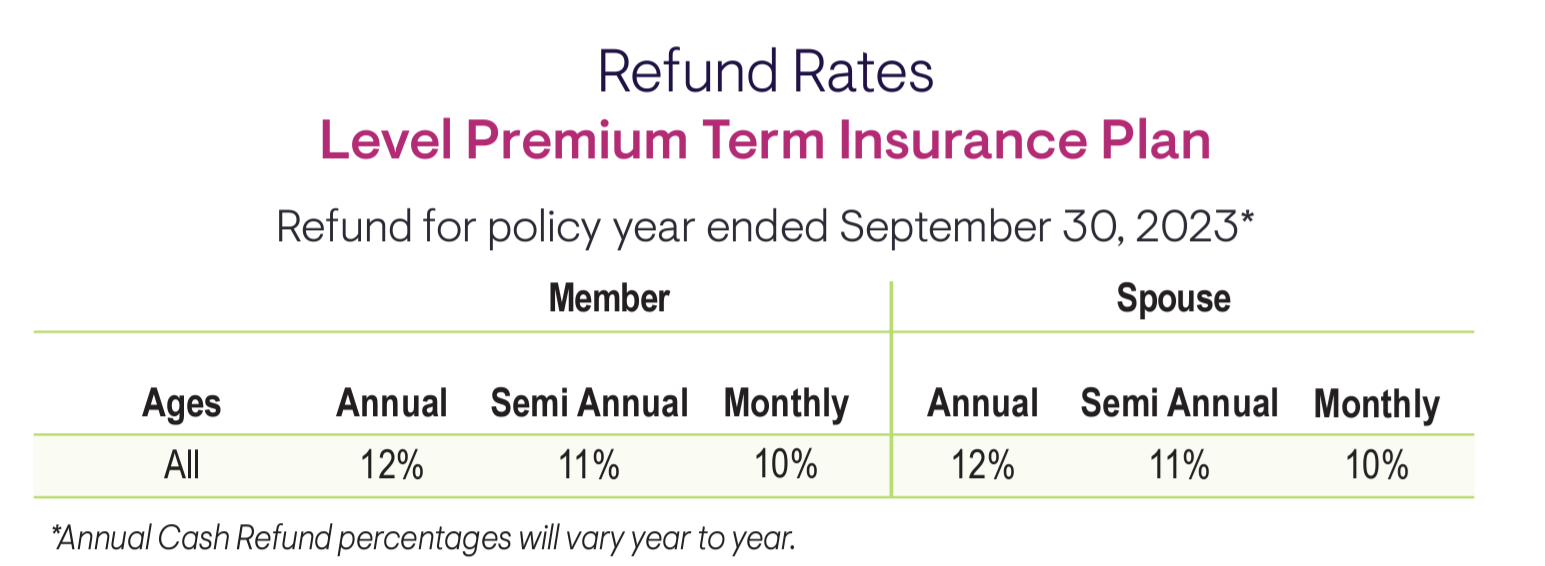

A degree premium term life insurance strategy allows you stick to your spending plan while you aid protect your family. ___ Aon Insurance Services is the brand name for the brokerage firm and program management procedures of Affinity Insurance coverage Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Agency, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Coverage Providers Inc.; in CA, Aon Fondness Insurance Policy Providers, Inc .

Latest Posts

Funeral Policy With No Waiting Period

Instant Life Insurance Cover

No Life Insurance Burial